How do I Check my New Jersey tax refund status?

- To view the status information, you must first select the tax year, enter your Social Security number, and the amount of the refund as shown on your tax return.

- If you’d like, you can also use the automated refund system by contacting 1-800-323-4400 to verify the progress of your refund.

- Four weeks or more following your electronic filing, twelve weeks or more following the mail-in return, or fifteen weeks or more in the case of paper returns delivered by certified mail or extra processing requirements are the earliest times you can begin monitoring the status of your refund.

- Your refund can take longer to process if it includes a New Jersey Earned Income Tax Credit (NJEITC) since these claims need more examination.

When will I get a tax refund in 2024?

The IRS aims to process electronic tax returns within 21 days in 2024. This indicates that the possible dates for refunds for those who filed between January 23 and January 28 are February 17 for direct deposit and February 24 for checks sent by mail. Every filing period follows a set of dates for refunds, as the timetable goes on.

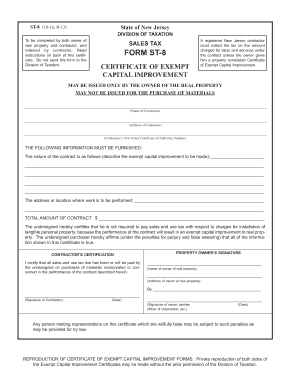

nj treasury department of taxation

The Treasury Department of Taxation is tasked with implementing tax laws, ensuring compliance, and providing information and support to taxpayers. It may also be involved in issuing tax refunds, conducting audits, and addressing any disputes or issues related to taxation.

If you have specific questions or concerns regarding your taxes in New Jersey, it is advisable to contact the New Jersey Treasury Department of Taxation directly or visit their official website for the most accurate and up-to-date information.

NJ Resale Certificate Form 2024